Invest in

GROWTH

Our mission is to maximize investment appreciation potential

by focusing on high growth, low marginal cost businesses.

Why AOT

AOT Invest (AOT) selects innovative companies which seek to significantly grow their revenues and earnings. AOT also believes companies whose products or services have low marginal cost attributes will be able to achieve above average growth and profit margins in the future. Thus, AOT selects innovative companies well positioned in expanding industries, that are both reasonably valued and have low marginal cost qualities.

Our Investment Philosophy

Low Marginal Cost:

The lower the cost of production of one additional unit of good or service, the better. This increases potential scalability and profitability.

High Revenue Growth Potential

High Innovation

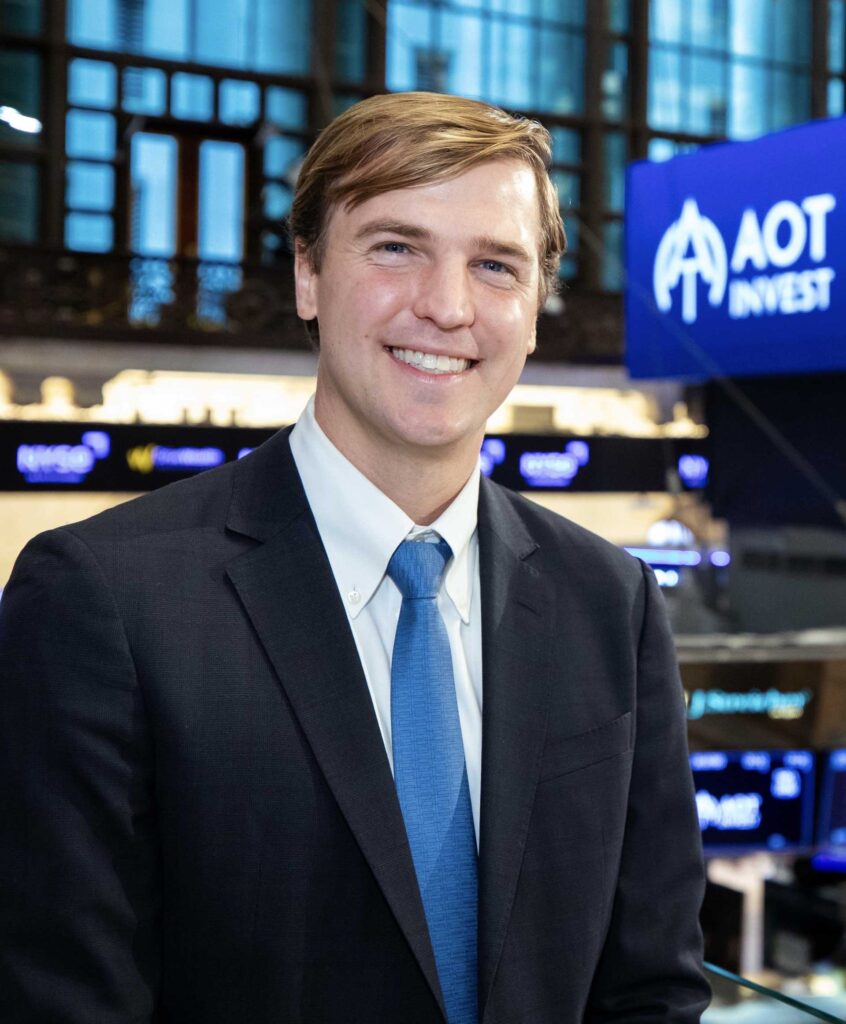

John Tinsman

CEO and Portfolio Manager

John Tinsman founded AOT Invest in 2022. Mr. Tinsman specializes in growth-oriented investing and uses his expertise to seek out long-term positions in high quality companies that he believes will achieve revenue and earnings growth rates above market and sector averages. Mr. Tinsman also seeks out innovative companies with low or zero marginal cost products and services, as he believes these characteristics raise the probability of a company achieving above average growth rates and share price appreciation. Mr. Tinsman obtained an undergraduate degree in Economics from Northwestern University, and he studied Economics and Management as a visiting student at the University of Oxford.

AOT Invest makes no representations, warranties, endorsements, or recommendations regarding any brokerage firms mentioned here. AOT Invest has not reviewed the brokerage firm’s websites and does not guarantee any claims or assumes any responsibility for the content, information, products or services found on the linked third-party websites. Brokerage firms and hyperlinks are provided herein as a convenience only. AOT Invest is not affiliated with any of the third-party entities mentioned herein.

Further Assistance

If you have any inquiries or questions, please contact us by calling 1.563.320.1688. Our team is ready to help and happy to connect.

Address:

3541 E Kimberly Rd

Davenport, Iowa 52807

Phone: +1.563.320.1688